New gTLD Registry Average Renewal Rates - 2023

Identity Digital’s consistency and volume outdistance the competition. Renewal Rates are a critical performance metric for domain registries. Let’s look at the 2023 average renewal rates for the Top 8 new gTLD registries. The average renewal rate for a new gTLD was 39% compared to 74% for .com in 2023 per the Domain Name Industry Brief (www.dnib.com) data. However, there is a substantial variance across the Top 8 New gTLD registries from 76% to 3% annual renewal rate. Let’s look a little deeper. The chart below depicts DNIB data for Expiring (dark blue columns) and Renewed (orange columns) domains during 2023 with the renewal rate shown in red. Renewal Rate is calculated by dividing the Renewals by the Expiring domain counts.

Google (46 new gTLDs) at 76% renewal rate with is the only registry that exceeds the .com reference renewal rate of 74% in 2023. Identity Digital (267 new gTLDs) is second at 64% followed by GoDaddy Registry at 54%. Only these three registries are above the 39% total renewal rate average for all new gTLDs. Radix (10 new gTLDs) and GMO Registry (6 new gTLDs) are at similar rates of 30% and 28% respectively. The next grouping ins Jiangsu (.top) and XYZ.COM (34 new gTLSs) at 21% and 18% respectively. Shortcut (5 new gTLDs) is lowest at 3%.

Each of these registries exhibit different approaches to operating their registry business. While Google has 46 new gTLDs, two, .app and .dev dominate their performance with renewal rates at 74% and 83% respectively. The other 44 Google new gTLDs have much less volume.

Identity Digital’s consistency and volume outdistance the competition. They have the largest portfolio of new gTLDs at 267 and they demonstrate a very long tail with strong renewal rates well above the new gTLD average. Ninety-two (92) TLDs have over 10,000 renewals. What is so striking about the Identity Digital performance is the consistency of Expiring to Renewals down the curve of all the gTLDs. Almost all TLDs have renewal rates above 40% and most above 50% - which stands in significant contrast XYZ.COM or Shortdot business models.

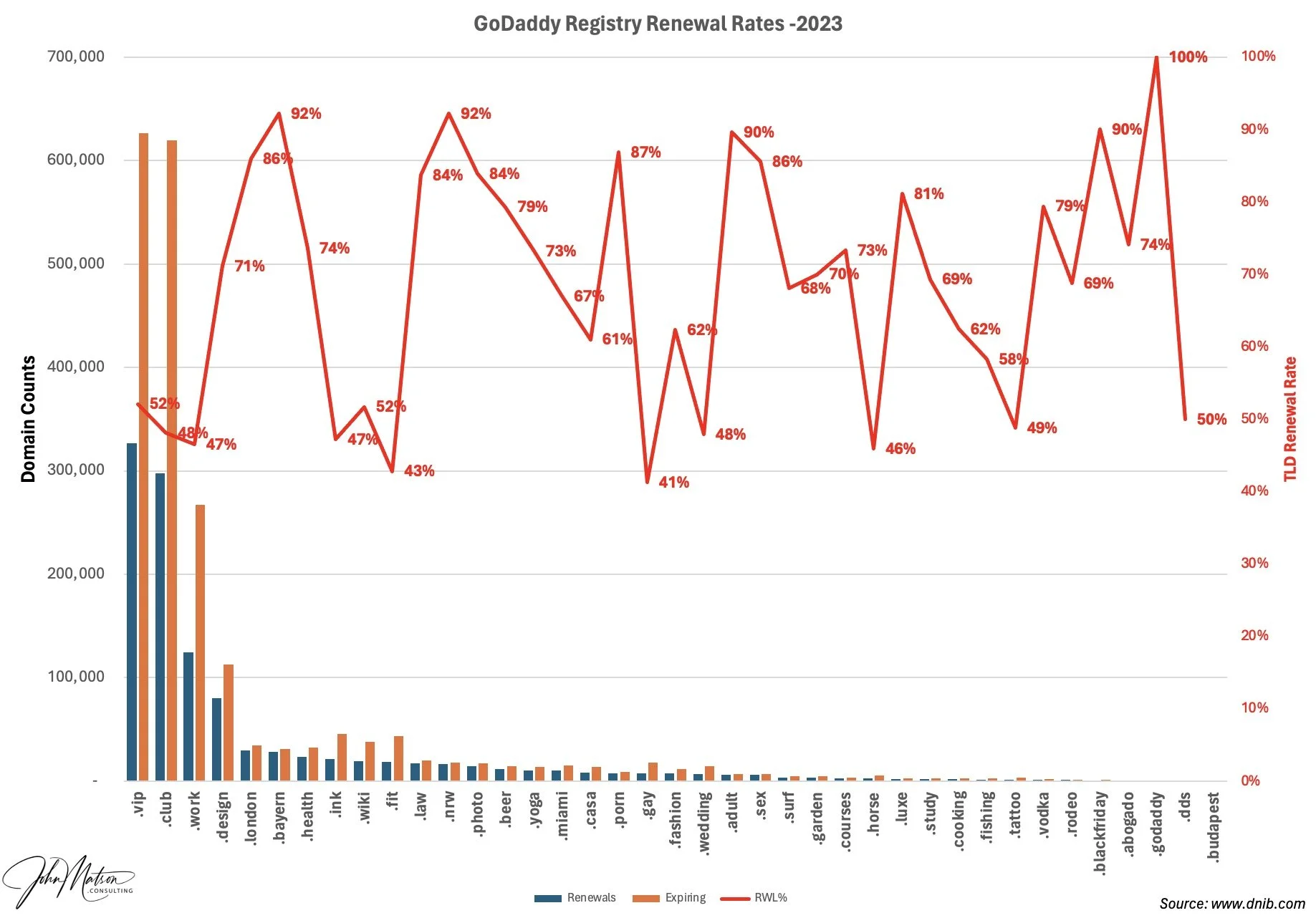

GoDaddy Registry on the other hand slots in between the Google and Identity Digital business models. GoDaddy has a smaller new gTLD portfolio at 39 so their tail is shorter than Identity Digital, but they do rely on more than just two TLD’s to drive their performance. GoDaddy achieves an average 54% renewal rate, 15 points above the new gTLD industry average with no TLDs below 40%. This would indicate more conservative new create acquisition approach than other registries.

Radix exhibits a different curve. With 10 new gTLDs Radix displays a more aggressive new create acquisition approach than the prior registries resulting in lower renewal rates.

GMO Registry primarily relies on the .shop TLD supported by .tokyo, .nagoya and .yokohama. Please check out my prior blog on City New gTLDs that analyzed how .tokyo has outdistanced all other city new gTLDs in domain volume, traffic and usage.

The Jiangsu registry only has the .top TLD that provides the 21% renewal rate.

XYZ.COM has been the annual leader in domain volumes since the launch of the new gTLD program through innovative new create programs including bundling and discounting. Now with 34 TLDs in the portfolio, there is a wide variation in renewal rates. .xyz dominates the performance at 18%, however over half the TLDs have over 50% renewal rates, but with very small volumes.

Shortdot rounds out the Top 8 new gTLD registries by registration volume. Their renewal performance is extremely low indicating a different business model than the other registries. The .icu TLD had over 800,000 domains expiring in 2023 with 27,200 renewals that rank 66th for renewals in new gTLDs. Time will tell how their approach plays out.